Unknown Facts About Frost Pllc

Unknown Facts About Frost Pllc

Blog Article

Frost Pllc Things To Know Before You Buy

Table of Contents9 Simple Techniques For Frost PllcHow Frost Pllc can Save You Time, Stress, and Money.The Ultimate Guide To Frost PllcHow Frost Pllc can Save You Time, Stress, and Money.

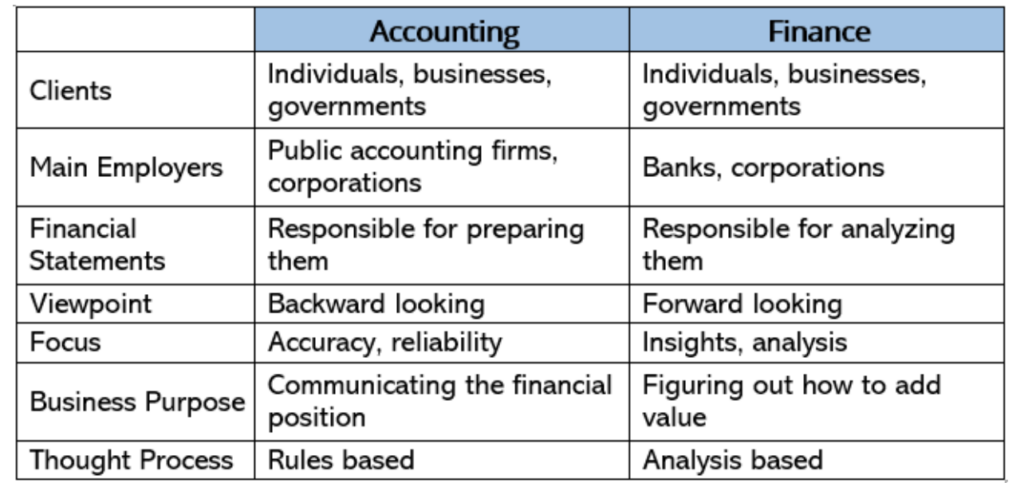

When it concerns monetary services, there are various sorts of companies readily available to pick from. 2 of the most typical are accounting companies and CPA companies. While they may appear comparable externally, there are some crucial distinctions between the 2 that can influence the sort of services they supply and the certifications of their personnel.One of the crucial distinctions between bookkeeping companies and certified public accountant companies is the credentials needed for their personnel. While both kinds of firms might use accountants and other monetary specialists, the 2nd one require that their personnel hold a CPA permit which is approved by the state board of accountancy and calls for passing a strenuous test, meeting education, and experience demands, and adhering to rigorous ethical requirements.

While some might hold a bachelor's degree in accountancy, others might have just finished some coursework in audit or have no formal education and learning in the field whatsoever. Both accountancy companies and certified public accountant firms supply a variety of financial services, such as accounting, tax prep work, and economic preparation. There are considerable distinctions in between the solutions they use.

These regulations may consist of requirements for continuing education and learning, honest requirements, and quality assurance procedures. Accounting companies, on the various other hand, might not be subject to the exact same level of law. Nevertheless, they might still be required to follow particular requirements, such as usually accepted accounting principles (GAAP) or global economic reporting criteria (IFRS).

Our Frost Pllc Diaries

These solutions may consist of tax preparation, audit solutions, forensic audit, and strategic data-driven evaluation (Frost PLLC). The range of solutions supplied by certified public accountant firms can differ substantially depending upon their dimension and focus. Some might specialize only in audit and guarantee solutions, while others may offer a wider array of solutions such as tax obligation preparation, enterprise danger administration, and consulting

In addition, certified public accountant companies might specialize in offering certain industries, such as health care, financing, or realty, and customize their services as necessary to fulfill the distinct needs of clients in these markets. There are differences in the fee frameworks of audit companies and CPA companies. Accounting companies might charge per hour prices for their solutions, or they may provide flat charges for specific jobs, such as accounting or financial declaration preparation.

Senior Manager and Certified Public Accountant with over 20 years of experience in accountancy and financial services, specializing in threat administration and governing conformity. Proficient in handling audits and leading teams to supply phenomenal solutions. The Difference In Between a Certified Public Accountant Company and an Accounting Firm.

Indicators on Frost Pllc You Should Know

Many accountancy firm leaders have actually established that the conventional collaboration version is not the method of the future. At the exact same time, investor rate of interest in expert solutions firms is at my blog an all-time high.

All testify services are executed just by the certified public accountant firm and overseen by its proprietors. The CPA company and the solutions business get in into a services agreement, according to which the services firm may provide expert team, workplace space, equipment, innovation, and back-office features such as invoicing and collections. The CPA firm pays the services company a cost for the services.

The following are a few of the key factors to consider for certified public accountant firms and capitalists pondering the formation of an alternate method structure. Certified public accountant firm ownership requirements are designed in component to insulate testify services and related judgments from industry stress. That means a CPA company supplying testify solutions have to continue to be a separate legal entity from the aligned solutions firm, with unique regulating papers and administration structures.

The bottom line is that events to an alternative technique framework need to thoroughly analyze the appropriate independence regimes and carry out controls to keep track of the certified public accountant company's self-reliance - Frost PLLC. Many alternative technique structure purchases include the transfer of nonattest interactions and associated files. Parties must take into consideration whether customer permission is needed and ideal notification also when consent is not needed

The smart Trick of Frost Pllc That Nobody is Discussing

Usually, any form of retired life setup existing at the CPA firm is terminated in link with the transaction, while puts and calls may apply check to partner possessed equity in the services business. Associated with the financial factors to consider, certified public accountant firms require to think about exactly how the next generation of firm accountants will be awarded as they achieve standing that would typically be come with by collaboration.

Both investors and certified public accountant companies will certainly need to stabilize the competing passions of staying clear of dilution while correctly incentivizing future company leaders. Capitalists and CPA companies require to address post-closing administration matters in the services business. A financier taking into consideration a control investment (and connected administration) in the services company need to take into consideration the broadened reach of the auditor independence policies in that scenario as contrasted to a minority investment.

Report this page